Project Showcase

Within our project showcase we display three projects with varying degree of complexity. Together with our download section this should give you an idea about our ability realize your projects.

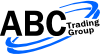

Book Ratio

Book Ratio The Depth of Market (DOM) displays the volume offered at bid and ask. By summing the levels for all volume at the ask and bid, you can calculate a book ratio. The order book will never be exactly balanced. One side can show a lot more volume [...]

Sentiment Index

Custom Sentiment Index Often times a project requires a study to be able to access data or values from other charts or sources like text files for examples. At the same time it’s crucial to accomplish this in a user friendly and easily customizable way. While it is possible [...]

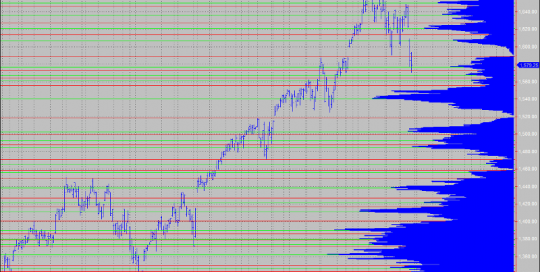

Volume Profile

Volume Profile Studies Today Multicharts has the build in ability to display Volume Profiles or Volume Delta charts. Before that we created several studies incorporating these features for customers. A more complex project was creating an external database to store the volume information at each price. This was done [...]