Volume and TPO Value Area Indicator and Function

Latest Update:

Version 1.04 – 2019-07-04

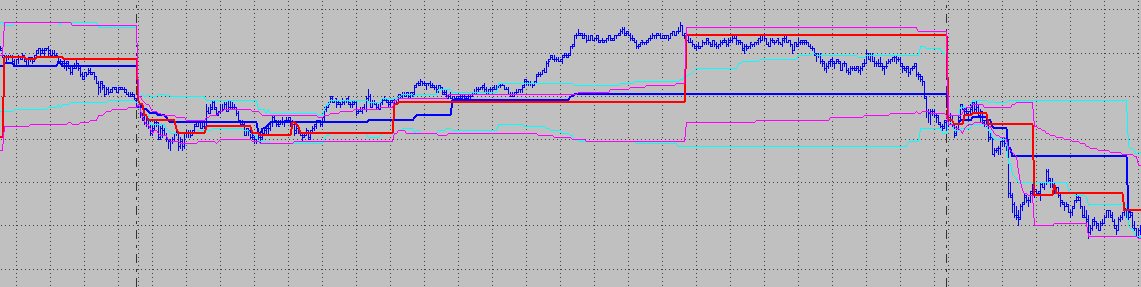

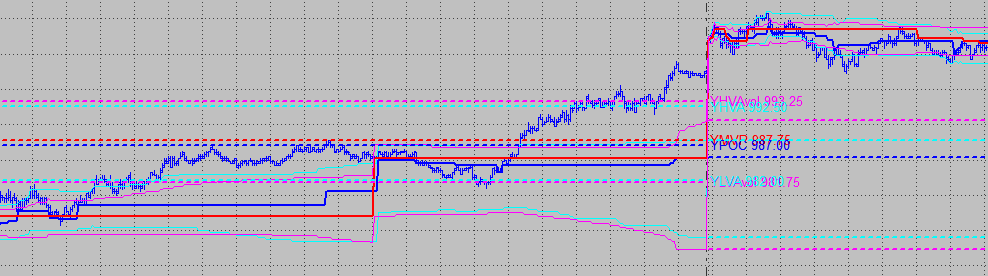

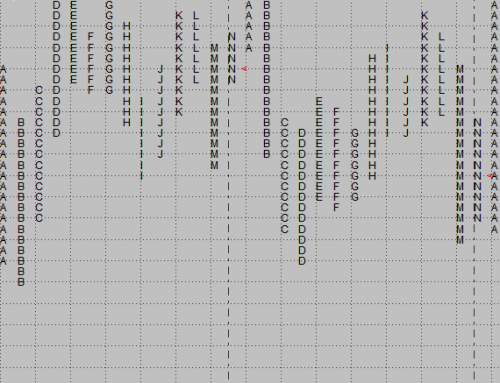

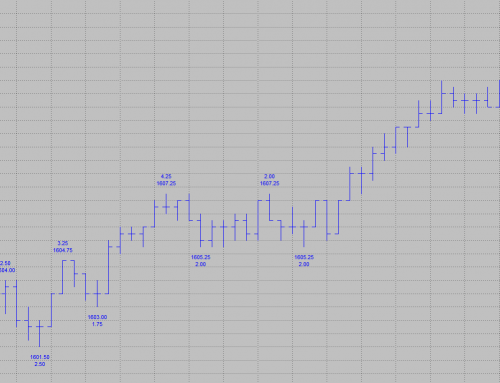

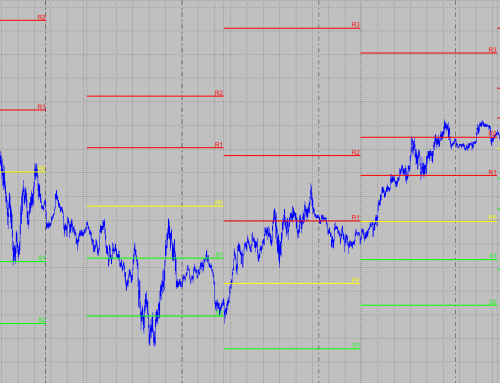

This indicator tracks the volume at each price and the Time Price Opportunity (TPO) count for the chart it is applied to. Based on this tracking it displays the price where the highest volume was traded and the price with the highest number of TPOs. These two values are called volume point of control (VPOC) and point of control (POC). The study also displays a value area around the VPOC and POC. The value area usually encompasses 70 % (roughly one standard deviation) of the daily volume (in case of the Volume Value Area) or the total TPO numbers for the day. This concept goes back to J. Peter Steidlmayer, who as a CBOT trader developed an intraday charting-technique called Market Profile[1].

Fast Calculation Using Minute Data

Multicharts comes with the ability to compute and display the value area build in, so why use a separate tool? First of all the TPO count is not build into Multicharts as of now, so this indicator offers additional features. Another difference is that this indicator computes the volume at price derived from the bar interval you apply it to. My suggestion would be to use a 1 minute bar interval for the computations. This allows for a longer history with most data providers compared to tick data, which is what the build-in volume tool uses. Wouldn’t volume profiles calculated from tick data offer more accurate results? This is correct, but our studies have shown that the difference when using one minute data usually is negligible. This means the significant values are usual exactly the same or fall within one tick of each other. For further information please check this research project comparing minute and tick data accuracy when it comes to the price of the volume point of control (VPOC).

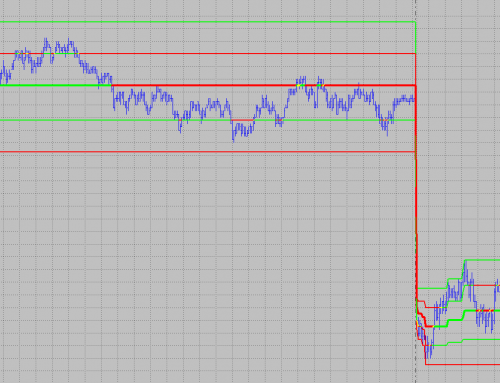

Use the Value Areas in your own indicator or system

One of the most unique features is that the tool comes with a function that allows you to access the realtime and historical values. You can use the values in your own studies and even use them within systems for automated trading. You will also receive a comprehensive manual that explains the inputs for both indicator and function, in case you want to customize the studies to your needs.

As a bonus a demo indicator is included that exactly shows you how to call the function, so you can easily use it in your own code. This way you can create your own signals and indicators that use the support and resistance values computed by the value area tool.

To receive your free copy for any of our tools simply subscribe to our mailing list. Besides that you will receive free updates and new free tools as soon as they are available. Upon subscription you will receive a mail with a confirmation link to your inbox. Follow the information provided in this mail and you will be able to receive the free Value Area Tool set within seconds. This toolset will work with Multicharts 9 and higher, it might not work in earlier versions and it won’t work in Multicharts.NET.

We highly value your privacy and we will never sell or share your information. In case you no longer want to receive information and tools from us for free, we have made unsubscribing easy for you with a link in every mail.

[1]. Market Profile® is a CME Group owned market data product. If you are interested in reading more information about it, the CBOT Market Profile six part study book is a good start. It’s available for free download via the CME website. If you are serious about it, I would suggest buying a copy of the great book Mind Over Markets by James F. Dalton, Eric T. Jones and Robert B. Dalton.

thanks a lot to share your research!

You are welcome.

I do not find the possibility to subscribe to you mailing list.

matteo,

the subscription box is present on every page that describes one of the indicators. If you can’t see it, it might be blocked on your end due to a browser add-on for example.

I would suggest to temporarily disable any add-ons that could block the subscription box or to try a different browser.

Regards,

ABC

Firefox will automatically hide the subscription box via Tracking Protection; so you have to disable that. (It’s not an add-on.)

Thank you for the comment. This will surely be helpful for viewers that don’t see the subscription box on their end, too.

Hi,awesome site! Thank you! Can your indicators work on tradestation?

Hi WJ,

thank you for your kind feedback. Most of the indicators are exclusive to Multicharts and are not available for Tradestation.

Regards,

ABC

Hello.. I do not see a download link for the indicator.. am i missing something? The input for my email to receive the free copy didn’t work either.. Could you send the indicator for workstation to me? Thank you very much :))

Jenov,

sometimes the signup form is blocked by a browser add-on or the confirmation mails end up in a spam or advertisement folder.

In case you don’t see the signup form, please try a different browser or temporarily disable the browser plugins that block the signup form.

Regards,

ABC

Can i use your Volume profile / Market profile tool in multichat.net 64 bit version?

vicky,

thank you for your interest in out studies. They are developed for the regular version of Multicharts and there are currently no versions for Multicharts.NET.

Regards,

ABC

I am studying an easylanguage coding to search POC of each 300-tick bar and record the POC values for strategy build-up. Do you have similar finding on it ? Thanks

Hi Eddie,

thank you for your comment. We don’t have any study readily available for that, but please feel free to contact us in case you are interested in hiring us for a custom programming project.

Regards,

ABC

Hi,

I found your indicators and articles really well done and useful, congratulations. Will you publish new indicators and articles?

Hi Fumo,

thank you for your post. Yes, new articles and studies are planned for the future, but we do not have an ETA, yet.

Regards,

ABC